After somewhat of a slow start to the year, bond issuance has gathered momentum. While this has been mainly led by governments and financial institutions issuance, good quality corporate issuers are also taking advantage of the market conditions to lock in funding and shore up capital.

This document has been prepared by FIIG Investment Strategy Group. Opinions expressed may differ from those of FIIG Credit Research.

Background

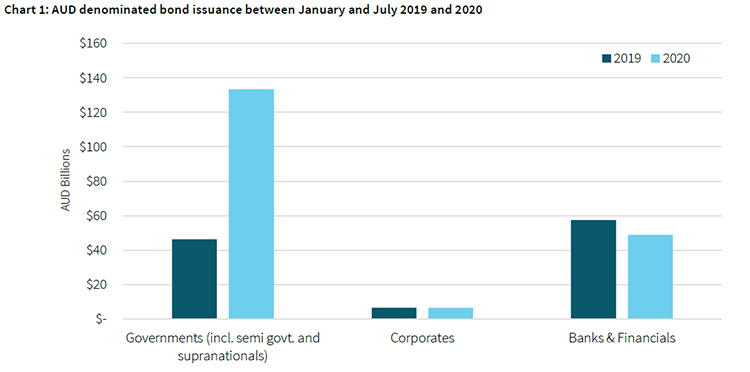

Over $190bn worth of AUD denominated bonds have been issued in the calendar year to 31 July 2020 across corporate, financial institution and government issuers. This data is based on Bloomberg information and excludes short dated securities such as T-bills as well as securitisation transactions.

What is surprising is that this figure is well ahead of that from the previous comparable period. In the calendar year to 31 July 2019, there was just over $110bn of bond issuance from corporates, financial institutions and governments. As expected, a vast majority of this increase in 2020 has been made up of issuance by government bodies as they raise funds to support the various programs and nation building projects aimed at supporting the economy in its current delicate state.

Source: Bloomberg, FIIG Securities

Government issuance

Between January and July 2019, issuance across the Commonwealth and state governments amounted to $43.5bn, whereas over the same period in 2020, these government entities issued over $127.8bn of bonds. The Commonwealth government alone has issued $93.2bn across five maturities this year, compared to one $22.5bn issuance in the first seven months of 2019. The Commonwealth government’s most recent bond had a maturity of 2051 and pays a coupon of 1.75%. The demand for bonds is so high at the moment that this bond, which was over 2-times oversubscribed at issuance, is already trading with a lower yield than at issuance.

Furthermore, the RBA is buoying the government bond market with its bond-buying programs aimed at yield curve control.

Outside of the Australian Commonwealth and state governments, the year to date AUD government bond issuance has been from government authorities such as the National Housing Finance and Investment Corp. and foreign government and supranational entities, such as The Korea Development Bank and Province of Alberta, Canada. These entities are regular Kangaroo issuers (offshore issuers of AUD bonds) and this AUD issuance is highly sought after by offshore investors given the Australian market is still offering yields well in excess of our global counterparts.

We are also seeing increased client interest in government bonds from private clients as investors look to improve their portfolio quality by including these higher rated bonds. The recent Commonwealth government 2051 bond and the QTC 2033 (older issuance) bond are two securities particularly sought after by investors.

Corporates and Financial Institutions

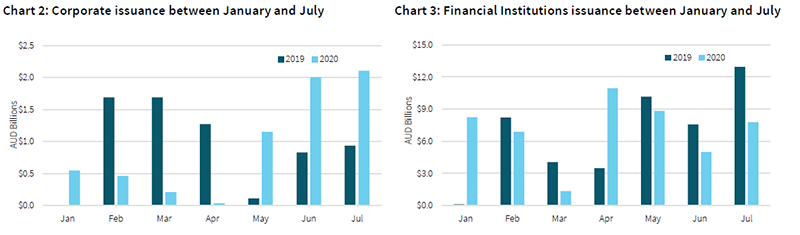

Unlike government bond issuance, corporate (including financials) issuance has lagged the volume seen in the first half of 2019. That is understandably so, especially given the financial market turmoil and general economic uncertainty experienced over this period.

Source: Bloomberg, FIIG Securities

Interestingly, issuance by corporates in the past three months has picked up significantly. The reasons behind this include increased investor demand coming from a system that is currently flush with cash and looking for investments; liquidity support provided by the RBA; and finally, the opportunity present for corporates to fill their coffers with cheaper funding to shore up balance sheets.

Additionally, the majority of issuance to date has been by higher investment grade rated corporate borrowers compared to previous years where we saw a lot more issuance from high yield borrowers. We believe high yield borrowers will certainly come back to the market once there is further certainty and investor demand back in the market.

In terms of financial institutions, there has been a large volume of issuance by offshore banks such as UBS, Morgan Stanley and Barclays with the majority of these bonds being senior ranking, unlike last year where there was a significant amount of subordinated Tier 2 capital bonds issued.

We expect that this Tier 2 issuance will start picking up in the second half of this year as banks and insurance companies once again refocus on their capital adequacy requirements. Genworth and Mystate have already issued Tier 2 bonds, and it is expected that other institutions such as IAG will shortly follow.

Conclusion

We are seeing a lot of investors sitting on the sidelines waiting to invest their cash in fixed income at a “better time”, however, as the saying goes “the best time to invest was yesterday”. We recently looked at performance of newly issued bonds, which shows that the current interest rate outlook means that yields are likely to continue to compress.

There are a number of primary market transactions that are in the pipeline and will issue following company results announcements and it is a good idea to keep your Relationship Manager informed of your interest in participating in these transactions as opportunities arise, as they may close at short notice.

Links

FIIG Investment Strategy – New issuance remains attractive