Mixed data out of China shows steep slowdown in private sector investment, but retail sales holding up

Fixed asset investment in China rose by 7.5% in May 2016, as opposed to the previous May, which compared to most economies is remarkable – however for China it represents a steep slowdown. Particularly concerning is the private sector, having slowed to just 1.9% annual growth, showing that the government did all the heavy lifting last month with a 19.8% increase. Share markets reacted negatively to the private sector data in particular as it shows that more stimulus will be required if China is to maintain its targeted rate of growth.

Fixed asset investment in China rose by 7.5% in May 2016, as opposed to the previous May, which compared to most economies is remarkable – however for China it represents a steep slowdown. Particularly concerning is the private sector, having slowed to just 1.9% annual growth, showing that the government did all the heavy lifting last month with a 19.8% increase. Share markets reacted negatively to the private sector data in particular as it shows that more stimulus will be required if China is to maintain its targeted rate of growth.

China’s data is published on a “year to date” basis, meaning that when they announce growth they are comparing January to May this year with January to May last year. Their official data showed a 9.6% increase, but that is comparing these five month periods. This odd approach creates some statistical noise that needs to be removed to really understand their economic health. Our 7.5% figure is simply the month of May 2016 compared to May 2015, as the rest of the world looks at economic data.

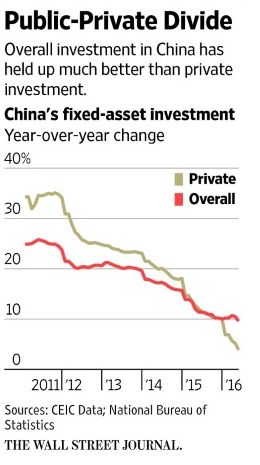

While it uses the “year to date” official figures, the chart from the Wall Street Journal tells the story well. Private investment in China has come to a halt. In some sectors this is actually welcome, so long as it doesn’t spill over into consumer confidence and retail sales. Investment is falling but sales are still high, meaning that bloated inventories will be run down. Auto sales for example rose by 11%, but production by only 5.5%; and residential housing construction rose by just 7%, while sales rose by a massive 33%.

Retail sales as a whole have held up well so far, and consumer confidence has fallen only moderately.

For Australian investors, this needs to be a watching brief. We need China to manage a soft landing, and that in turn will require retail sales and consumer confidence to hold up while the industrial economy inevitably weakens further. In parallel to this, investors need to watch for signs of bad debts rising from China’s very rapid growth in corporate and local government credit. If credit growth can be eased without hurting retail spending, China will likely manage a graceful slowdown, which would be good news for the global economy but great news for Australia.